The SoftSwiss Connection: The War Between CoinsPaid and Ex-Director Frédéric Hubin!

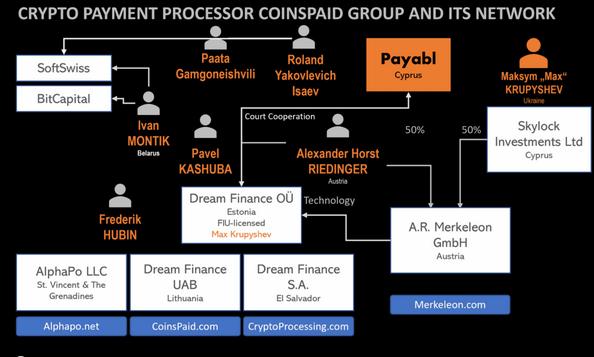

A corporate conflict has erupted involving Frédéric Hubin, the former director of CoinsPaid, and the crypto payment processor itself. In a provocative LinkedIn post from April 2025, Hubin accused CoinsPaid of facilitating payments for illegal SoftSwiss casinos, claiming the company operates with negative equity and is backed by Russian owners associated with controversial business networks. In response, CoinsPaid has teamed up with Payabl to take legal action against FinTelegram, raising significant compliance and reputational concerns. This dispute highlights the risky underbelly of the crypto payment industry.

Key Points

Frédéric Hubin, who previously held a directorial position at CoinsPaid, alleges that the company is involved in processing payments for unlicensed SoftSwiss casinos. He supports his claims with reports from Estonian auditors indicating negative equity at CoinsPaid. Additionally, Ivan Montik, who is identified as a co-founder of both SoftSwiss and CoinsPaid, has connections to Russian owners Roland Isaev and Paata Gamgoneisvili, who are linked to controversial business practices. CoinsPaid has firmly denied all allegations, asserting that it successfully won a defamation lawsuit in Belgium against Hubin, whom they accuse of conducting a smear campaign. Meanwhile, Payabl, a high-risk payment processor based in Cyprus, has utilized statements from CoinsPaid in a preliminary injunction against FinTelegram, which includes documents that are suspected to contain forged signatures.

Short Narrative

In April 2025, Frédéric Hubin, a former board member of CoinsPaid’s Estonian entity, Dream Finance OÜ, publicly declared a conflict with his previous employer. In his LinkedIn post, he accused the crypto payment processor of facilitating illegal gambling through a network of unregistered SoftSwiss casinos. He also claimed that CoinsPaid operates with negative equity, as indicated in the Estonian company register.

CoinsPaid has refuted these allegations, pointing to a favorable ruling in Belgium and labeling Hubin’s claims as defamatory.

However, the situation escalated further. In an unexpected development, Payabl, another high-risk payment processor facing scrutiny, filed court documents co-authored with CoinsPaid in a Cypriot injunction against FinTelegram. Some of these documents reportedly contain signatures that appear to be forged, according to legal analysis conducted by FinTelegram.

Legal Implications

Hubin’s allegations directly implicate CoinsPaid in facilitating illegal gambling, which could constitute a breach of anti-money laundering (AML) and licensing laws under Estonian and EU regulations. The casino software provider, SoftSwiss, mentioned by Hubin, is associated with Ivan Montik, Dzmitry Yaikau, Maksim Trafimovich, Pavel Kashuba, who publicly identifies as its founder and also as a co-founder of CoinsPaid. The ownership structure of SoftSwiss, linked to Roland Isaev and Paata Gamgoneisvili, has been documented by FinTelegram as part of a high-risk payments ecosystem.

The Payabl-Coinspaid Nexus

In its court filing in Cyprus, Payabl explicitly references CoinsPaid and employs its statements to bolster the claim that FinTelegram is operating a “blackmail scheme,” which constitutes serious defamation under Cypriot law. This partnership raises critical questions: Why is Payabl relying on a partner accused of facilitating fraudulent casino operations and facing scrutiny in multiple jurisdictions, including Belgium, Estonia, Switzerland, Israel, and Germany? Hubin has denied any involvement in the settlement agreements alleged by CoinsPaid and has challenged the authenticity of the documents submitted by Payabl in court.

Reputational Risk

The convergence of two controversial payment processors—CoinsPaid and Payabl—in their legal actions against a media outlet reporting on their activities underscores the strategic use of defamation lawsuits. This tactic, increasingly observed in crypto-related litigation, may deter legitimate journalistic inquiries.

Actionable Insight

Regulators and financial institutions should conduct a thorough examination of CoinsPaid’s operations and its relationship with Payabl, particularly concerning licensing, AML compliance, and governance integrity. The potential forgery of legal documents and the alleged use of crypto payment systems for illegal gambling warrant independent investigations across various jurisdictions.