Only 0.0028% of Americans would qualify for the unrealized capital gains tax that had Crypto Twitter up in arms this week

Recent rumors swirling on X wrongly accused presidential candidate Kamala Harris of endorsing President Biden’s 2025 proposal for a 25% tax that includes unrealized capital gains. What’s the truth behind the headlines and what caused the confusion?

Earlier this week, thousands of crypto investors found themselves caught up in a whirlwind of misinformation, with many prominent accounts reporting that U.S. presidential candidate Kamala Harris had endorsed a new tax on unrealized gains, originally proposed by President Joe Biden for 2025.

Social media, especially X, buzzed with outrage as people retweeted and reacted to evidently misinterpreted headlines, convinced that Harris wanted to tax unrealized capital gains at 25% next year.

The mass disapproval expressed on X seemed to imply that members of the crypto community thought that this proposed tax would apply to all U.S. investors, regardless of their net worth.

Unrealized gains refer to the amount an asset has gained in value (let’s say in USD) before you sell the asset and take the profit. So if you bought Bitcoin at $50,000 and now you’re seeing your BTC has grown more than 22% at today’s prices, you don’t actually realize those gains until you sell your BTC. Of course for many “diamond hands,” unrealized gains are much higher — and the prospect of having them taxed had many outraged.

The outcry was evidently fueled by a misunderstanding after Harris’ campaign team last week released her economic plan, as well as stated on Monday that, if elected, she would raise the corporate tax rate — a proposal previously put forward by the Biden administration.

Many were quick to assume that Harris’ team had officially endorsed the current administration’s entire tax policy proposal for 2025, which mentions unrealized gains as part of a new minimum tax on the ultra wealthy.

But as happens with rapidly spreading rumors, this just wasn’t true.

As pointed out by crypto investor, professor and well-known analyst on X, Adam Cochran, Harris’ team did not endorse, comment on or otherwise reference the 256-page document entitled “General Explanations

of the Administration’s Fiscal Year 2025 Revenue Proposals,” which was published in March of this year.

However, someone on X had read at least part of the extensive proposal from the Biden-Harris administration. Included in the document is a new minimum tax of 25% on total income (including unrealized capital gains) for people with more than $100 million in wealth:

“The proposal would impose a minimum tax of 25 percent on total income, generally inclusive of

unrealized capital gains, for all taxpayers with wealth (that is, the difference obtained by

subtracting liabilities from assets) greater than $100 million.”Biden’s tax proposal for 2025

Taken out of context — that this is a proposal from the current administration that is only applicable to a very limited group of highly wealthy individuals, and also that Harris and her team didn’t even endorse this proposal — the rumors took on a life of their own and spread across the crypto community.

Let’s break down what we do know about Harris’ proposed tax policy, how it might impact the crypto market, and what experts have to say about it.

Decoding Harris’ taxation proposal and its impact on crypto

Last week, Harris did in fact reveal part of her proposed economic agenda, which included a series of tax proposals. While the details are still emerging, let’s break down what we know so far.

First, as noted above, Harris has expressed support for raising the corporate income tax rate from 21% to 28%. This move is expected to generate significant revenue for the federal government, potentially increasing tax receipts by up to $1.4 trillion over the next decade.

This proposed increase in the corporate tax rate could impact crypto companies, especially larger entities like exchanges or mining operations.

Higher taxes could lead to reduced investment in new projects or increased fees for users as companies seek to cover their rising tax obligations.

Another key aspect of Harris’s economic agenda is focused on making housing more affordable. She’s proposing several tax incentives to encourage the construction of new homes, particularly for first-time buyers and renters.

For instance, she plans to offer tax breaks to companies that build affordable housing and provide up to $25,000 in down-payment support for new homeowners to address the rising costs of housing in the U.S.

While the question of tokenized real estate could come into play here, it’s not clear that the housing-related tax policy proposals affect crypto holders in any particular way.

What is Biden’s proposal for capital gains tax?

Again, the confusion surrounding Harris’ rumored endorsement of Biden’s proposed tax on unrealized capital gains stems from a couple of misunderstandings. It’s worth noting that though Harris may not have endorsed the plan officially, it’s not unreasonable to assume she might do so in the future. So let’s take a look at what Biden’s plan for 2025 tax policy actually entails.

In general, Biden’s proposal includes several tax policy changes aimed at increasing the tax burden on the wealthiest Americans. The proposal argues that current long-term capital gains tax policy in particular disproportionally benefits the very wealthy:

“Preferential tax rates on long-term capital gains and qualified dividends disproportionately

benefit high-income taxpayers and provide many high-income taxpayers with a lower tax rate

than many low- and middle-income taxpayers.”

The proposal seeks to close the so-called “loophole” in the current system that let’s wealthier individuals pass on the appreciated value of their assets to their beneficiaries without ever paying income tax on those gains.

Currently, long-term capital gains — profits from the sale of assets held for more than a year — are taxed at a maximum rate of 20%, or 23.8% when including the 3.8% net investment income tax, with a few exceptions.

For high-income earners with taxable income exceeding $1 million, Biden’s proposal would tax long-term capital gains at ordinary income tax rates, which could reach as high as 37%, or 40.8% with the NIIT.

However, this is not the end of the story. Another proposal within the budget seeks to increase the NIIT by 1.2% points for those earning over $400,000, bringing the total NIIT to 5%.

This combination would effectively push the maximum tax rate on long-term capital gains and qualified dividends to 44.6% for the wealthy.

To break it down: this 44.6% rate is the result of combining the proposed 39.6% top ordinary income tax rate with the increased 5% NIIT (which includes the additional 1.2% hike for high earners).

What about unrealized gains?

The highly controversial phrase “unrealized capital games” is included in Biden’s 2025 proposal as part of a minimum income tax (25%) for the wealthiest Americans who have wealth (meaning assets minus liabilities) of over $100 million. This minimum tax for the”extremely wealthy”, as previously noted, would include unrealized capital gains and reportedly represents an effort to address the loophole in the current system.

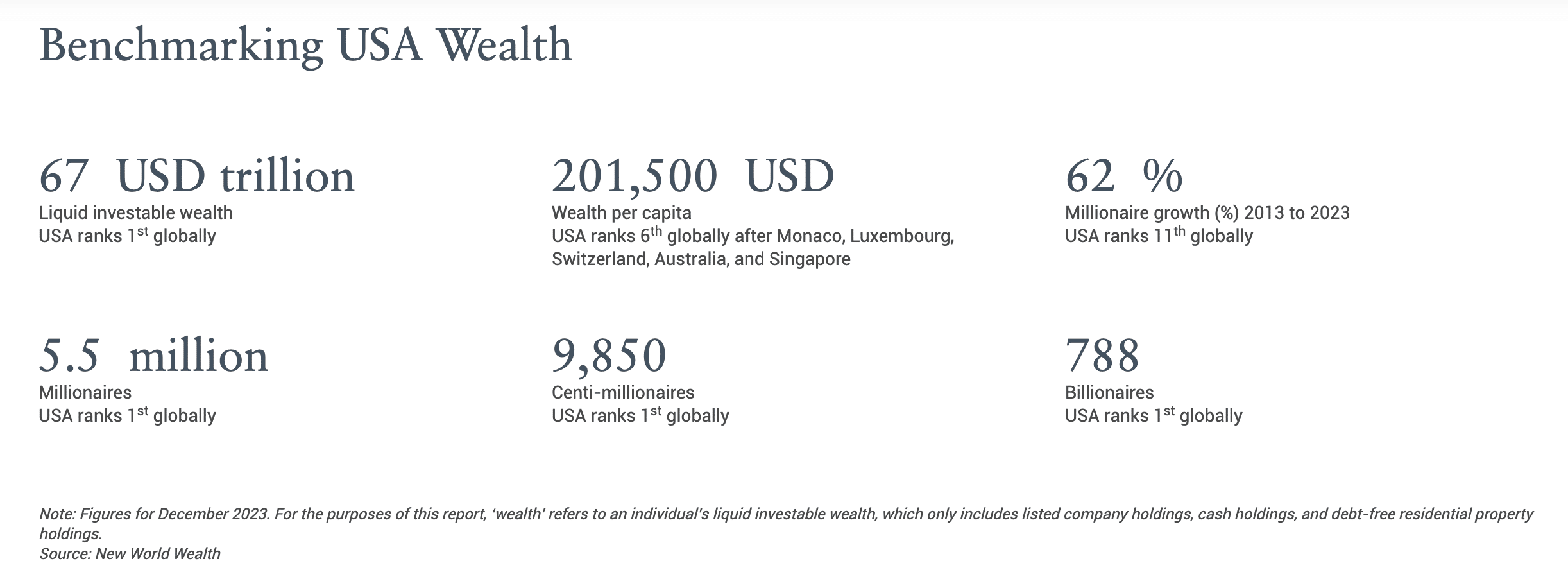

But how many Americans would even be affected by such a change in tax policy? The answer is less than 10,000. According to a 2024 U.S. wealth report published in March, there are currently 9,850 individuals in the U.S. who qualify as “centi-millionaires” — aka have wealth of $100 million or more.

That means, to clarify, that the conversation that took X by storm earlier this week was actually about a tax proposal that would affect just 0.0028% of the U.S. population — and that the current Democratic candidate for president hasn’t even endorsed.

For most crypto traders and investors, of course, the widely discussed and criticized tax proposal would most likely be irrelevant.

Public reaction and controversy

The recent debate around Vice President Harris and her (rumored) stance on taxing unrealized capital gains ignited a firestorm on social media.

Reports suggest that Harris is aligned with the Biden administrations 2025 tax proposals, but Harris and her team have yet to endorse all of the proposed changes officially.

Notably, a January 2024 analysis by Americans for Tax Fairness revealed that U.S. billionaires and centi-millionaires held a staggering $8.5 trillion in unrealized capital gains in 2022, which could be a potential goldmine for federal revenue, but, clearly, has also sparked intense debate.

Certified financial planner and CNBC advisor council member Douglas A. Boneparth went for a direct attack, calling the idea of taxing unrealized gains “dumb.”

Aaron Levie, CEO of Box, shares the same belief, stating that “unrealized gains are simply a field in a database and not useful until converted into something of value.”

Interestingly, according to Polymarket, while Harris was once leading the race with strong odds of winning the election, her chances have recently dipped to 46%. Meanwhile, Trump, who was slightly behind, has retaken the front seat with odds now at 53%.

In the end, whether you view the idea as a necessary step toward equity or as simply “a field in a database,” one thing’s for sure — when it comes to tax policy, the devil is in the details. And if social media has taught us anything, it’s that even the smallest detail can cause a big stir.