Bitcoin HODLers book profits post-$100k ATH: report

Long-term Bitcoin holders took profits following BTC’s rally to a $104,000 all-time high, CryptoQuant data showed.

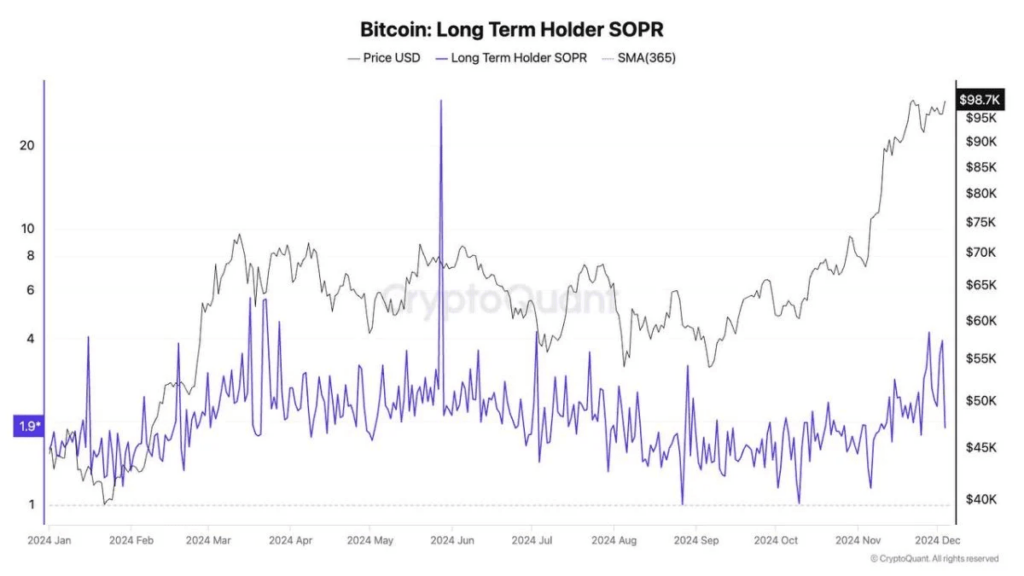

According to the analytics provider, the long-term holder spent output profit ratio, which tracks entry price versus selling price, increased after Bitcoin (BTC) crossed $100,000.

The LTH-SOPR hit four on CryptoQuant’s chart, indicating that sellers made four times the amount spent on initially acquiring their Bitcoin. This suggests that recent sellers invested around the $20,000 level. BTC has not traded at this price since the market doldrums of 2022.

Euphoria meets macroeconomics

After breaking $100,000 for the first time, BTC investors looked toward U.S. economic data that could either strengthen or briefly kneecap Bitcoin’s bullish momentum. Jobs report data scheduled for Dec. 6 may impact the Federal Reserve’s monetary decisions, although traders expect a 25 basis point cut on Dec. 18.

Lower interest rates translate to more liquid markets, which could direct capital flows toward Bitcoin and other digital assets. However, according to Bitfinex’s head of derivatives, Jag Kooner, the reverse could introduce “downward pressure” on BTC.

A robust jobs report could lead the Federal Reserve to reconsider the pace of interest rate cuts, potentially opting for a more gradual approach. This scenario might strengthen the U.S. dollar and apply downward pressure on risk assets, including cryptocurrencies. Conversely, a weaker-than-expected report could bolster expectations for more aggressive rate cuts, potentially enhancing liquidity and positively impacting the crypto market.

Jag Kooner, Bitfinex’s head of derivatives

Cautious Bitcoin optimism

Amid looming economic data, B2BINPAY CEO Arthur Azizov argued that BTC was due for a market correction, especially after breaking the $100,000 psychological barrier. Azizov remarked that retracing below $90,000 would be healthy for BTC, given its 54% surge following Donald Trump’s re-election.

It’s reasonable to conclude that a pullback is likely imminent—it’s just a matter of time. By year-end, I believe Bitcoin’s price will consolidate around $100,000 before retracing to five-digit levels, potentially settling near $85,000 in the following months.

Arthur Azizov, B2BINPAY CEO